irs tax levy calculator

Use this tool to. File your tax return on time.

It is different from a lien while a lien makes a claim to your assets as.

. The IRS can levy or legally seize a taxpayers property to satisfy an outstanding back taxes. We are experienced tax attorneys in Houston Texas. The levy is released.

A levy is a legal seizure of your property to satisfy a tax debt. If the percentage is 15 enter 15 as a decimal. 6323 6331-6335 6338 6339 and 26 CFR Part 403.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Use the IRS Circular Es tax withholding tables to calculate federal income tax. For help with your withholding you may use the Tax Withholding Estimator.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Irs issues notice of intent to levy in a letter numbered cp504 asking you to pay the tax due within 10 days of service of that letter. If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until.

The IRS charges a penalty for various reasons including if you dont. This includes helping clients get levy releases. IRS tax forms.

Levies are different from liens. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. Help With an IRS Tax Levy.

Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent as of 2011. Taxpayers who dont meet their tax obligations may owe a penalty. IRS tax forms.

You can use the Tax Withholding. As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay. For employees withholding is the amount of federal income tax withheld from your paycheck.

This authority is covered in 26 USC. When the levy is on a bank credit union or similar account the Internal Revenue Code provides for a 21-day waiting period before the bank must comply with the levy. A tax levy is a legal seizure on wages to satisfy a tax debt.

Tax changes as a result of the Tax Cuts and Jobs Act have altered the way. The IRS can garnish wages take money from your bank account seize your property. We help clients with IRS levies and other collection matters.

By using this site you agree to the use of cookies. I have an employee who has a 2100 tax levy as of 032007s notice. Employers generally have at least one full pay period after receiving a notice of levy on wages to begin withholding the required.

The information you give your employer on Form W4. Information About Wage Levies. Estimate your federal income tax withholding.

IRS has the authority to seize property to collect outstanding debt owed to the US. How to Calculate Wage Tax Levy. Part of your wages.

Enter the percentage from section 2 b 1 of the Wage Garnishment Order may not exceed 15. A lien is a legal claim against property to secure payment of the tax debt while a. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes.

See how your refund take-home pay or tax due are affected by withholding amount. Checking your withholding can. A tax levy is a.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Free Tax Problem Resolution Resources From Maryland Tax Attorneys

What Happens If The Irs Sends You To Collections

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Home Protax Irs Back Tax Tax Debt Relief

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Should You Move To A State With No Income Tax Forbes Advisor

Levy On Accounts Receivable Justice Tax Llc

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Llc Tax Calculator Definitive Small Business Tax Estimator

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

/u-s-tax-filing-1090495926-e2d35df4094146a587089d7b3158e64c.jpg)

Types Of Income The Irs Can T Touch

How Do State And Local Property Taxes Work Tax Policy Center

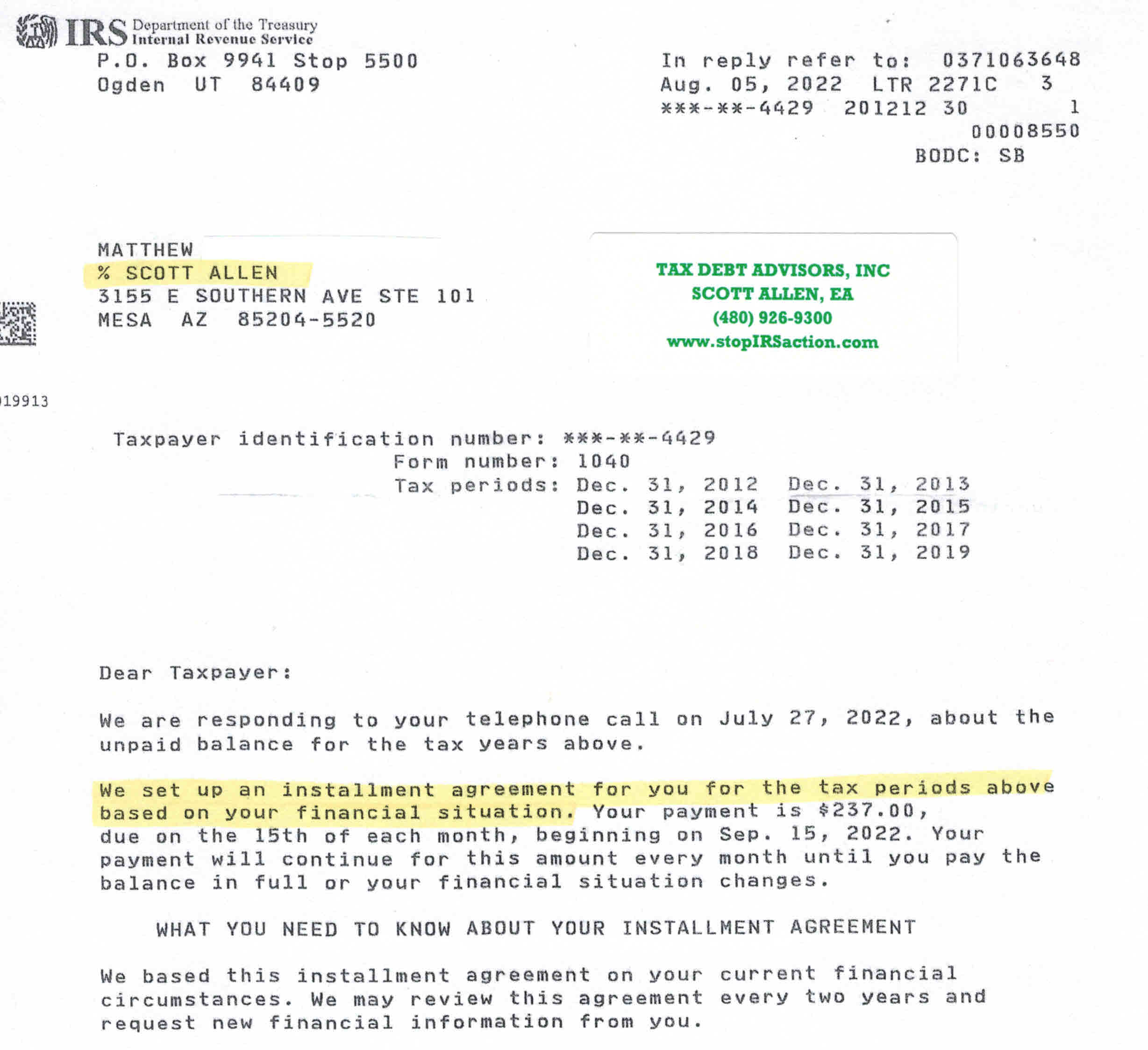

Irs Payment Plan Installment Agreement Options Nerdwallet

Phoenix Az Irs Tax Attorney Tax Debt Advisors

Best Tax Attorneys Lawyers In Minnetonka Get Free Consultation